Off-Plan Projects for Sale in Dubai: Your Comprehensive 2026 Investment Guide

Welcome to the dynamic world of off-plan properties in Dubai, where visionary developments are shaping the city’s skyline before they’re even built. If you’re searching for off-plan projects for sale in Dubai, you’re tapping into one of the most exciting segments of the real estate market. In 2026, Dubai’s off-plan scene is buzzing with opportunities, driven by innovative projects, flexible payment plans, and a market that’s stabilising after years of rapid growth. As an expert in Dubai’s property landscape, I’ll walk you through everything you need to know about off-plan real estate in Dubai, from trends and top locations to practical buying tips, all while keeping things straightforward and actionable.

Dubai has long been a magnet for investors, and off-plan developments in Dubai continue to attract both locals and internationals. Whether you’re eyeing off plan homes for sale in Dubai for personal use or as an investment, understanding the Dubai off-plan property market is key to making informed decisions. Let’s dive in and explore why 2026 could be your perfect entry point.

What Are Off-Plan Projects and Why Do They Matter in Dubai?

Off-plan projects refer to properties sold before construction is complete or sometimes even before it begins. In Dubai, these include apartments, villas, townhouses, and more, often marketed with detailed renders, floor plans, and promised amenities. Buyers commit early, paying in instalments, and receive the keys upon handover.

Why does this matter in 2026? Dubai’s real estate market is maturing, with off-plan sales making up over 60% of transactions. This model allows developers to fund projects while offering buyers lower entry prices. For instance, in areas like Dubai Creek Harbour, off-plan purchases can yield significant appreciation upon completion.

The Evolution of the Dubai Off-Plan Property Market in 2026

Entering 2026, the Dubai off-plan property market is shifting toward more selective, logic-based buying. After a post-pandemic boom, we’re seeing calmer demand, with investors focusing on prime locations and sustainable growth. Trends show a 40-60% rise in off-plan interest from Gen Z and non-resident Indians (NRIs), drawn by digital nomad visas and remote work appeal.

Market data indicates stabilisation, with possible mild price adjustments in oversupplied areas, but premium spots like Palm Jumeirah remain resilient. Off-plan developments in Dubai are emphasising eco-friendly features, smart tech, and community living to align with global trends.

Key Benefits of Investing in Off-Plan Properties in Dubai

Investing in off-plan properties in Dubai offers several advantages that make it appealing for 2026 buyers:

- Affordable Entry Points: Purchase at pre-construction prices, often 20-30% below ready properties.

- Flexible Payment Plans: Spread costs over 2-5 years, sometimes post-handover, easing cash flow.

- High Potential ROI: Properties can appreciate 15-25% by handover due to market growth.

- Customisation Options: Influence layouts or finishes in early stages.

- No Capital Gains Tax: Sell without tax burdens, boosting net returns.

These perks make off-plan homes for sale in Dubai a smart choice for first-time investors or those building portfolios.

Potential Drawbacks and Risks of Buying Off-Plan in Dubai

While rewarding, off-plan real estate in Dubai isn’t without challenges. In 2026, be mindful of:

- Construction Delays: Projects can overrun, though RERA regulations minimise this.

- Market Fluctuations: If demand dips, resale values might not rise as expected.

- Inability to Inspect: You’re buying based on plans, so developer reputation is crucial.

- Financing Hurdles: Mortgages for off-plan require higher down payments (up to 50% for non-residents).

Mitigate risks by choosing RERA-approved developers and consulting experts.

Top Trends Shaping Off-Plan Developments in Dubai for 2026

2026 trends in off-plan developments in Dubai include:

- Sustainability Focus: Projects incorporating green tech, like solar panels and water recycling.

- Metro Connectivity: Areas near new Blue Line extensions are seeing heightened interest.

- Luxury Wellness Communities: Developments with spas, parks, and health facilities.

- Digital Integration: Smart homes with AI controls are becoming standard.

- Investor Demographics Shift: More young professionals and families opting for affordable luxury.

These trends ensure off-plan projects for sale in Dubai remain future-proof.

Best Areas for Off-Plan Investments in Dubai

When scouting off-plan properties in Dubai, location is paramount. Here are prime spots for 2026:

- Dubai Creek Harbour: “Downtown 2.0” with waterfront views and high ROI potential.

- Dubai Hills Estate: Family-friendly with golf courses and schools.

- Palm Jebel Ali: Emerging island luxury, ideal for villas.

- Emaar Beachfront: Private beaches and marina access.

- Dubai South: Airport proximity for logistics-focused investors.

- Jumeirah Village Circle (JVC): Affordable, community-driven options.

- Business Bay: Commercial hub with skyline views.

- The Oasis: Green retreats amid urban bustle.

Emerging Neighbourhoods for Off-Plan Homes in Dubai

As Dubai continues to evolve into a global hub for innovation and luxury living, 2026 is spotlighting several emerging neighbourhoods that promise high growth potential for off-plan investments. These areas are characterised by ongoing infrastructure developments, strategic locations, and a focus on sustainable, community-oriented designs. Unlike established districts like Downtown Dubai or Business Bay, these up-and-coming spots offer lower entry prices, often 15-25% below prime areas,s while positioning buyers for substantial appreciation as projects mature. Key drivers include Dubai’s Vision 2040 urban plan, which emphasises expansion into new waterfronts, green spaces, and connectivity hubs.

One standout emerging area is the Dubai Islands (formerly known as Deira Islands), a Nakheel-developed archipelago that’s redefining waterfront living. This cluster of five islands spans over 17 square kilometres and is set to feature luxury resorts, marinas, beaches, and residential communities. In 2026, off-plan projects here are attracting investors with promises of high rental yields (up to 7-9% annually) due to their proximity to Dubai International Airport and the upcoming Blue Line metro extension. Infrastructure like the Infinity Bridge and enhanced road networks are accelerating development, making it ideal for waterfront villas and apartments. Early buyers can secure units starting from AED 1.2 million, with handover timelines aligning with major events like the Dubai Expo legacy projects.

The Artificial Islands of Dubai: Palm Jumeirah and more

Another rising star is Majan, a value-driven community in Dubailand that’s gaining traction for its affordable yet upscale off-plan homes. Majan offers a mix of townhouses, apartments, and villas, with prices starting as low as AED 800,000 for studios. Its appeal lies in the master-planned environment, including parks, schools, and retail hubs, all within a 15-minute drive from key attractions like Global Village and IMG Worlds of Adventure.

By 2026, with the completion of Etihad Rail connections and Al Qudra Road expansions, property values here are projected to rise 20-30%, driven by demand from young families and first-time investors seeking suburban tranquillity with urban access. Developers like Dubai Properties are launching eco-friendly projects emphasizing green building standards, further boosting its attractiveness in the Dubai off-plan property market.

Other notable emerging neighbourhoods include Palm Jebel Ali, which is emerging as a new luxury icon with off-plan villas offering private beaches and yacht berths; Emaar South, a future aviation hub near Al Maktoum International Airport ideal for logistics-focused investments; and Nad Al Sheba Gardens, known for its equestrian-themed communities and green landscapes. These areas are seeing a surge in off-plan developments in Dubai, with trends leaning toward smart homes integrated with AI and renewable energy sources. For investors eyeing off plan homes for sale in Dubai, these neighbourhoods provide a balance of affordability and long-term ROI, especially as Dubai’s population is expected to reach 5.8 million by 2040, fueling demand for expansive living spaces.

To rank highly for searches like “emerging off-plan neighbourhoods in Dubai 2026,” focus on local intent by highlighting specific projects, such as Nakheel’s Dubai Islands masterplan or Majan’s integrated communities, which align with buyer queries on value-driven investments.

How to Evaluate Developers for Off-Plan Projects in Dubai

Selecting the right developer is crucial when investing in off-plan real estate in Dubai, as it directly impacts project delivery, quality, and overall returns. In 2026, with over 50,000 off-plan units in the pipeline, buyers must adopt a data-driven approach to mitigate risks like delays or subpar construction. Start by prioritising RERA-registered developers, as mandated by Dubai’s Real Estate Regulatory Agency, which ensures escrow account protections where your payments are held until milestones are met, safeguarding against defaults.

Reputable developers like Emaar, DAMAC, and Sobha stand out for their proven track records. Emaar, for instance, has delivered iconic projects like Burj Khalifa and Dubai Hills Estate on time, with a portfolio boasting over 80,000 units handed over. Evaluate their history by checking completion rates: Aim for developers with at least 90% on-time delivery over the past decade. Use tools like the Dubai Land Department (DLD) portal to review past projects’ handover timelines and buyer feedback. Additionally, assess financial stability look for publicly listed companies or those backed by strong conglomerates to ensure they can weather market fluctuations.

Most Iconic Emaar Projects in Dubai | Provident Estate

Key evaluation criteria include:

- Project Portfolio and Quality: Examine completed developments for build quality, amenities, and sustainability features. For 2026, prioritise those incorporating green certifications like LEED, as Dubai pushes for eco-friendly off-plan developments.

- Payment Structures and Incentives: Reliable developers offer flexible plans, such as 60/40 splits (60% during construction, 40% post-handover), with zero-interest options. Avoid those with aggressive upfront demands without clear milestones.

- Customer Reviews and Legal Compliance: Scour forums, Google reviews, and the RERA complaints database. Ensure the project has an approved master plan and escrow setup.

- ROI Projections: Analyse historical appreciation in their communities. Emaar’s projects have averaged 15-20% annual growth, per market reports.

- Innovation and Vision: In 2026, top developers are integrating smart tech, like AI-managed security and wellness apps, aligning with Dubai’s smart city goals.

Common pitfalls to avoid: Overlooking smaller developers without due diligence, as they may offer lower prices but higher risks. Instead, cross-reference with independent valuations and consult certified agents. By focusing on these factors, you’ll secure off-plan projects for sale in Dubai that not only meet but exceed expectations, enhancing your position in the competitive Dubai off-plan property market.

For Google ranking, incorporate question-based subheadings like “What Makes a Developer Reliable for Off-Plan in Dubai?” to target voice search and featured snippets, while weaving in keywords naturally.

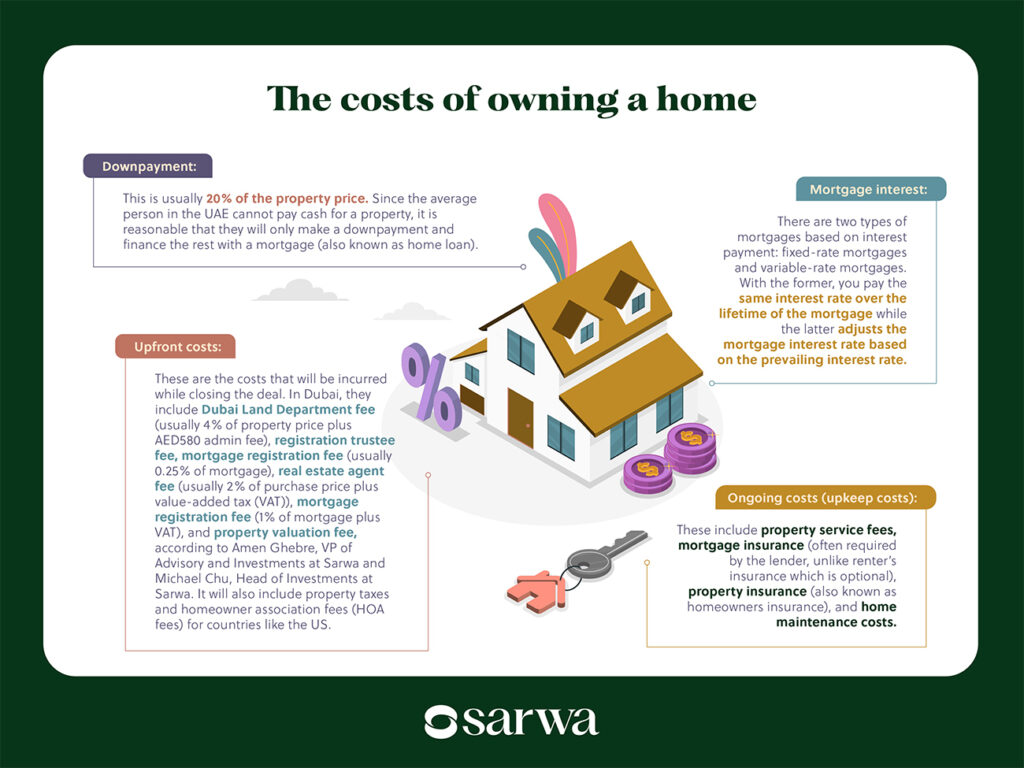

Financing Options for Buying Off-Plan Real Estate in Dubai

Financing off-plan properties in Dubai has become more accessible and diverse in 2026, catering to both residents and non-residents amid a stabilising market. With property prices averaging AED 2,500 per square foot in emerging areas, understanding your options can unlock deals with minimal upfront capital. The two primary routes are developer payment plans and bank mortgages, often combined for optimal flexibility.

Developer Payment Plans

These are interest-free schemes offered directly by builders, making them popular for off-plan purchases. In 2026, typical structures include 10-20% down payments, followed by instalments tied to construction progress (e.g., 50% during build, 30-40% on handover). Post-handover plans, extending up to 5 years, are increasingly common, allowing buyers to pay after moving in or renting out. Developers like DAMAC and Emaar provide tailored options, such as 1% monthly payments, ideal for cash-flow management. Benefits include no credit checks and lower initial costs, but ensure the plan is RERA-approved to protect your funds.

Bank Mortgages for Off-Plan

UAE banks like Emirates NBD and Dubai Islamic Bank offer off-plan mortgages with loan-to-value (LTV) ratios of 50-80% for residents (up to 50% for non-residents). Interest rates hover at 4-6% variable, influenced by the UAE Central Bank’s policies. Eligibility requires a minimum salary (AED 15,000 for UAE nationals, higher for expats), stable employment, and a clean credit history via the Al Etihad Credit Bureau. Non-residents face stricter checks, including international income verification, but can access up to 50% financing through global lenders like HSBC. Pre-approvals are key—get one before reserving to lock in rates.

Renting vs. Owning a Home in the UAE: What’s the Best Choice?

Other options include Islamic Financing (Sharia-compliant, using Murabaha structures instead of interest) and Bridging Loans for short-term gaps. Risks involve potential rate hikes or delays affecting payments, so factor in a 10-15% buffer. Costs to budget: 2-4% arrangement fees, valuation reports (AED 3,000+), and DLD registration (4% of property value).

For 2026, with market growth projected at 5-7%, combining a developer plan with a mortgage can yield a strong ROI, especially in off-plan developments in Dubai like the Dubai Islands. Consult financial advisors to simulate scenarios, ensuring alignment with your goals in the Dubai off-plan property market.

Step-by-Step Guide: How to Buy Off-Plan Properties in Dubai

Buying off-plan in Dubai is straightforward:

- Research Projects: Use platforms like ZameenInfo.com to compare options.

- Select and Reserve: Pay a small deposit (5-10%) to hold your unit.

- Sign Sales Purchase Agreement (SPA): Review terms with a lawyer.

- Make Payments: Via escrow, tied to construction milestones.

- Handover and Title Deed: Receive keys and register with DLD.

This process ensures transparency.

Essential Documents Needed for Off-Plan Purchases in Dubai in 2026

Buying off-plan properties in Dubai requires careful preparation of documents to ensure a smooth, secure transaction. In 2026, the process remains highly regulated by the Dubai Land Department (DLD) and Real Estate Regulatory Agency (RERA), emphasising transparency and buyer protection.

Whether you’re a resident or non-resident investor eyeing off plan projects for sale in Dubai, having the right paperwork ready avoids delays and complies with UAE laws. Below is a comprehensive breakdown of essential documents, tailored for different buyer types and scenarios.

Core Documents for All Buyers

These are mandatory when reserving or signing the Sales Purchase Agreement (SPA) directly with the developer:

- Valid Passport Copy Required for all buyers, including signature and visa pages (if applicable).

- UAE Residence Visa Copy. For residents, non-residents can proceed without it.

- Emirates ID Copy Mandatory for UAE residents.

- Proof of Address: Utility bill, tenancy contract, or similar (especially for non-residents applying for mortgages).

- Signed Reservation Form Provided by the developer to secure your unit (often with a 5-10% deposit).

- Sales and Purchase Agreement (SPA): The key contract outlining price, payment plan, handover date, and terms. Must be registered via the Oqood system (DLD’s interim register for off-plan sales).

Additional Documents for Mortgage Financing

If financing your off-plan real estate in Dubai, banks require proof of financial stability. Non-residents often face stricter checks and higher down payments (40-50%):

- Bank Statements: Last 3-6 months.

- Proof of Income: Salary certificate, employment letter, tax returns, or audited financials (for self-employed).

- Credit History Report: International credit record if applying from abroad.

- Down Payment Proof:Receipt for initial booking fee.

Documents for Reselling an Off-Plan Property

You can resell before handover (typically after 40-50% payments), but you’ll need:

- No Objection Certificate (NOC) from the developer confirming no outstanding dues (fee: AED 500-1,000).

- Original SPA and Payment Receipts to prove your ownership and payments.

At the Handover Stage

Upon project completion:

- Proof of All Payments: Full clearance receipts.

- Developer’s Completion Certificate Issued after snagging inspection.

- Title Deed Application Submitted to DLD for final registration (fee: 4% of purchase price,e split buyer/seller).

Pro Tip for 2026 Buyers: Always verify the project’s registration and escrow account on the Dubai REST app or DLD portal before submitting documents. This ensures your off-plan developments in Dubai are legitimate. Engage a RERA-registered agent for assistancewith many listings on platforms like ZameenInfo.com, which include document checklists.

| Document Type | Required For | Residents | Non-Residents | Mortgage Needed |

|---|---|---|---|---|

| Passport Copy | All Buyers | Yes | Yes | Yes |

| Emirates ID | Reservation/SPA | Yes | No | Optional |

| Proof of Income | Mortgage | Yes | Yes | Yes |

| NOC | Resale/Transfer | Yes | Yes | No |

| SPA Registration | Oqood | Yes | Yes | Yes |

Preparing these in advance makes buying off-plan homes for sale in Dubai efficient and stress-free.

Understanding Payment Plans in Dubai Off-Plan Developments for 2026

One of the biggest attractions of the Dubai off-plan property market in 2026 is the flexible payment plans offered by developers. These plans make off-plan properties in Dubai accessible, spreading costs over years, often interest-freeand aligning with construction progress.

Unlike ready properties requiring full upfront payment (minus mortgage), off-plan allows you to pay in instalments, reducing initial outlay while potentially benefiting from price appreciation.

Common Payment Plan Structures in 2026

Developers tailor plans to attract buyers, with post-handover options gaining popularity for cash flow ease:

- 60/40 or 70/30 Plan Pay 60-70% during construction (tied to milestones like foundation, structure completion), 30-40% on handover. Popular for balanced risk.

- 80/20 Plan 80% during construction, 20% on handovercommon in high-demand projects.

- 50/50 Plan: Even split; ideal for premium developments.

- Post-Handover Plans (e.g., 40/60 or 20/80) Pay a portion (e.g., 40-60%) during construction, the rest in monthly/quarterly instalments after handover (1-5 years). Great for investors planning rental income to cover payments.

- 1% Monthly Plans. After an initial 10-20% down, pay 1% per month, highly flexible for mid-tier buyers.

Example Breakdown (Typical for an AED 1M Apartment):

| Phase | Percentage | Amount (AED) | Timing |

|---|---|---|---|

| Booking/Reservation | 10-20% | 100K-200K | Immediate |

| During Construction | 40-60% | 400K-600K | Milestone-linked (e.g., 10% every 20% completion) |

| On Handover | 20-40% | 200K-400K | Key receipt |

| Post-Handover (if applicable) | Remaining | Spread over 2-5 years | Monthly/Quarterly |

In 2026, expect more post-handover extensions from developers like Emaar, DAMAC, and Sobha to compete in a maturing market. Payments go directly into the project’s escrow account, ensuring funds are used only for construction.

Benefits: Lower entry barriers, potential 15-25% appreciation by handover, no interest on developer plans. Considerations: Late payments can lead to penalties or cancellation (capped forfeiture under RERA rules). Compare plans across off-plan developments in Dubai via sites like ZameenInfo.com for the best fit.

Legal Protections for Buyers in the Dubai Off-Plan Property Market in 2026

Dubai’s off-plan real estate in Dubai is one of the world’s most buyer-friendly markets, thanks to robust regulations from RERA and DLD. Introduced post-2008 to rebuild trust, these protections centred on escrow accounts safeguard your investment in off-plan projects for sale in Dubai.

Key Protection: Mandatory Escrow Accounts (Law No. 8 of 2007)

- All buyer payments must be deposited into a project-specific escrow account managed by a RERA-approved bank.

- Funds are released only upon verified construction milestones (audited by independent engineers).

- Protects against misuse if a developer faces issues, funds remain ring-fenced for completion or refunds.

- 5% of funds are retained for one year post-handover to cover defects (snagging).

Additional Buyer Safeguards in 2026

- Project Registration: Developers must register with DLD/RERA before sales; check status via the Dubai REST app (includes completion %, photos, escrow details).

- Contract Cancellation Rules: If projects are delayed excessively or fail, RERA can cancel and order full refunds (plus interest in some cases).

- Default Protections: If you default, developers can retain only a capped amount (e.g., 30-40%); excess refunded.

- Digital Tracking Enhancements: In 2026, real-time progress updates, AI-monitored compliance, and stricter penalties for violations.

- Dispute Resolution: Fast-track via Rental Disputes Centre or specialised tribunals.

Why This Matters for 2026 Investors: With thousands of units launching, these rules minimise risks in the booming Dubai off-plan property market. Always verify escrow on the DLD portal and choose reputable developers.

| Protection Mechanism | What It Covers | Authority |

|---|---|---|

| Escrow Account | Fund security & milestone releases | RERA/DLD |

| Oqood Registration | Interim ownership proof | DLD |

| Defect Guarantee | Post-handover repairs | Escrow Law |

| Cancellation Rights | Refunds on project failure | RERA |

These layers make investing in off-plan properties in Dubai secure, explore options like off-plan apartments confidently.

Top Off-Plan Projects with 2026 Handover in Dubai

Here’s a summary table of notable projects (data informed by market insights from ZameenInfo.com):

| Project Name | Location | Type | Starting Price (AED) | Key Features | Expected ROI |

|---|---|---|---|---|---|

| Solaya | La Mer | Apartments | 1.5M | Beachfront, luxury amenities | 15-20% |

| Maison Margiela Residences | Palm Jumeirah | Villas | 5M | Branded interiors, private pools | 18-25% |

| Numa Reserve | Dubai Hills | Townhouses | 2.8M | Golf views, community parks | 12-18% |

| Emaar Beachfront Towers | Emaar Beachfront | Apartments | 1.2M | Marina access, gyms | 14-20% |

| The Oasis Residences | The Oasis | Villas | 3.5M | Eco-friendly, spas | 16-22% |

| Dubai Creek Harbour Views | Dubai Creek Harbour | Apartments | 1M | Waterfront, retail hubs | 15-25% |

These represent diverse options in the Dubai off-plan property market.

Comparing Off-Plan vs. Ready Properties in Dubai for 2026 Investors

In 2026, Dubai’s real estate market continues to mature, with investors increasingly weighing off-plan properties in Dubai against ready ones. Off-plan projects sold before or during construction dominate sales, often comprising 60-70% of transactions due to attractive pricing and payment flexibility. Ready properties, fully completed and move-in ready, appeal to those seeking immediate use or rental income.

Here’s a detailed side-by-side comparison to help you decide:

| Factor | Off-Plan Properties | Ready Properties |

|---|---|---|

| Price | A higher market rate reflects the current value and immediate availability. | Higher market rate reflects the current value and immediate availability. |

| Payment Plans | Highly flexible (e.g., 60/40, 70/30, or 1% monthly; often post-handover options). | Usually, a full payment or mortgage; larger upfront down payment is required. |

| Capital Appreciation | High potential (12-20% by handover in prime areas like Dubai Creek Harbour). | Lower short-term gains; value tied to existing market conditions. |

| Rental Income | Delayed until handover; strong post-2026 yields (7-10%) expected. | Immediate; current yields around 6-8% in established areas. |

| Customization | Often possible (finishes, layouts in early phases). | Limited; renovations post-purchase only. |

| Risk Level | Higher (delays, market shifts); mitigated by RERA escrow protections. | Lower; physical inspection possible, no construction risks. |

| Availability | Abundant in 2026 with major handovers; prime units sell fast. | Scarcer in luxury segments; more options in secondary market. |

| Best For | Long-term investors (2-5 years horizon) seeking growth in emerging areas. | End-users or short-term income seekers prioritizing stability. |

In 2026, off-plan edges out for investors focused on long-term gains, especially in growing communities like Dubai South or JVC, where infrastructure boosts value. Ready properties shine for immediate lifestyle or cash flow, particularly in mature spots like Dubai Marina. With supply surging (over 120,000 units in 2026), off-plan offers better entry pricing amid moderating growth.

Rental Potential of Off-Plan Homes for Sale in Dubai

Post-handover, off-plan homes in Dubai deliver strong rental returns, making them a cornerstone of the Dubai off-plan property market. In 2026, as thousands of units are completed, average gross yields range from 6-9%, outperforming many global cities.

Key insights for 2026:

- JVC (Jumeirah Village Circle) Mid-market favourite with yields of 7-9.5% for apartments; studios and 1-beds often hit 8%+. Affordable pricing and family demand drive occupancy.

- Dubai Hills Estate Premium family community; apartment yields around 5-6%, villas 4.5-5.5%. Lower yields offset by appreciation and longer tenancies.

- Other High-Yield Areas: Dubai South (airport proximity) and Business Bay target 7-8%; waterfront spots like Dubai Marina hold 6-8%.

Factors influencing projections:

- Supply Impact Increased 2026 deliveries may soften rents slightly in high-volume areas, but prime locations remain resilient.

- Net Yields Subtract service charges (AED 15-25/sq ft annually), vacancy (aim for <10%), and management fees for a realistic 5-7% net.

- Short-Term Rentals Tourist zones boost yields to 10-12% via platforms like Airbnb.

For off-plan homes for sale in Dubai, handing over in 2026-2027, target sustainable communities for stable 7%+ returns. Browse options like off-plan apartments on ZameenInfo.com.

Selling Your Off-Plan Property: Rules and Strategies in Dubai

Yes, you can sell an off-plan property in Dubai before completion, often called “flipping” or assignment. This is common in the thriving off-plan real estate Dubai scene, allowing profits from price appreciation.

Key Rules in 2026:

- Minimum Payment Threshold Most developers require 30-50% paid (e.g., Emaar: 40%; DAMAC: 35-40%).

- No Objection Certificate (NOC) Mandatory from the developer; confirms no dues and approves transfer.

Process:

- Meet threshold and request NOC (processing: 1-4 weeks).

- Find a buyer and sign an MOU.

- Transfer via DLD trustee office; buyer assumes remaining payments.

Fees:

- NOC: AED 500-5,000 (often buyer pays).

- DLD Transfer: 4% of the original price.

- Agent Commission: ~2%.

Strategies for Success:

- Time sales after 40% construction for higher premiums.

- Target high-demand projects in areas like Palm Jebel Ali.

- No capital gains tax maximises profits.

Selling off-plan remains profitable and straightforward with reputable developers.

Tax Implications for Off-Plan Investments in Dubai

Dubai’s tax-free environment is a major draw for off-plan developments for Dubai investors in 2026. No annual property tax, no income tax on rentals, and no capital gains tax on sales, whether off-plan flips or long-term holds.

Key Points:

- One-Time Fees 4% DLD transfer fee on purchase/transfer; Oqood registration (~AED 2,000-5,000 for off-plan).

- VAT Exempt on first residential sales (including off-plan); 5% on commercial.

- Rental Income 100% tax-free for individuals.

- Inheritance/Other No inheritance tax; corporate holders may face 9% UAE tax if applicable.

This structure enhances ROI, especially for off-plan, where appreciation (12-20%) is tax-free. Ideal for international buyers building wealth.

Future Outlook: Dubai Off-Plan Market Beyond 2026

Beyond 2026, Dubai’s off-plan market shifts toward quality and sustainability amid peaking supply (120,000+ units in 2026, 70,000+ in 2027).

Trends:

- Moderating Growth: Prices stabilise or soften mildly in mid-market; prime/luxury resilient with 3-5% annual rises.

- Supply Dynamics: Post-2027 deliveries drop sharply; scarcity in waterfront/villas drives premiums.

- Focus Areas: Sustainable, smart-tech projects; wellness communities; metro-connected hubs like Dubai South.

- Demand Drivers: Population growth to 4.5M+; HNWI influx; infrastructure (Blue Line Metro, Etihad Rail).

Off-plan remains dominant for early gains, but selectivity is key. Long-term: balanced, mature market favouring quality developments.

Tips for First-Time Buyers in the Dubai Off-Plan Property Market

Entering the Dubai off-plan property market as a first-timer in 2026? Focus on research and protection.

Top Tips:

- Choose Reputable Developers. Stick to Emaar, DAMAC, Sobha, and check track records on DLD/RERA sites.

- Budget Wisely Factor 4% DLD fee, service charges, and potential delays.

- Understand Payments. Opt for flexible plans; ensure escrow protection.

- Location Matters Prioritise connected areas (e.g., near Metro extensions) for appreciation.

- Due Diligence Visit sites, review SPAs with lawyers, monitor progress.

- Use Trusted Platforms. Explore listings on ZameenInfo.com for studios, 2-bedroom apartments, or more.

- Long-Term View Off-plan suits 3-5 year horizons; consider Golden Visa eligibility.

FAQs

Is Buying Off-Plan a Good Idea in Dubai?

Absolutely, especially in 2026. Off-plan properties in Dubai offer lower prices, flexible payments, and strong appreciation potential. With RERA protections, risks are managed, making it ideal for investors seeking high ROI in a stable market. However, it’s best for those with a 2-3 year horizon.

Where Is the Best Place to Buy Off-Plan in Dubai?

The best places include Dubai Creek Harbour for waterfront appeal, Dubai Hills Estate for family living, and Palm Jebel Ali for luxury. In 2026, focus on areas with metro expansions, like Dubai South for growth. Check listings on ZameenInfo.com for specific options like off-plan apartments.

How to Buy Off-Plan in Dubai?

Start by researching projects on sites like ZameenInfo.com. Reserve with a deposit, sign the SPA, pay in stages via escrow, and await handover. Engage a real estate agent and a lawyer for smooth navigation. For 2026, prioritise developers with proven track records.

Can You Sell an Off-Plan Property in Dubai?

Yes, you can sell after reaching construction milestones (often 40%). Get a NOC from the developer, pay any fees, and transfer via DLD. It’s straightforward and tax-free, allowing quick flips if market conditions favour it.

What Are the Main Risks of Buying Off-Plan Properties in Dubai?

Key risks include delays, market downturns, and developer issues. In 2026, mitigate by choosing RERA-approved projects and diversifying. Always review contracts thoroughly.

Conclusion

Navigating off-plan projects for sale in Dubai in 2026 opens doors to lucrative opportunities in one of the world’s most vibrant markets. From the allure of off-plan developments in Dubai to the practicalities of buying and selling, this guide equips you with the knowledge to invest confidently. Remember, success lies in research and choosing reliable sources like ZameenInfo.com for listings, whether it’s studios or 2-bedroom apartments.